Once-in-a-lifetime window for high-risk, high-reward bets? This year's market has been lackluster, with a 1:1 risk-reward ratio considered decent, but recently it's been a classic 'pump and dump' script: 'profits like a chick pecking rice, losses like an elephant taking a dump.' U.S. stocks plummet, the crypto market is stagnant, trading volume halved compared to March, and the market keeps painting doors, long-short squeezing. The quieter it is, the more likely it is the calm before the storm. The real reversal often hides in this dead silence.

In the past 24 hours, 87,150 people were liquidated across the network, with liquidation totaling $204 million. Long positions liquidated $99.4939 million, short positions liquidated $105 million.

BTC

Bitcoin has been oscillating for 17 days since falling to 80,600 on November 21st. The time is sufficient, and the direction will be decided in the coming days. The price is still fluctuating within the 12-hour Bollinger Bands but is gradually narrowing to the 4-hour Bollinger Bands, compressing to the extreme. Expect increased short-term volatility; please be aware of the risks.

Trading suggestion: If it breaks above 92,600, the rebound could continue, challenging the 94,185 and 96,012 levels. If it breaks below 87,600, the rebound ends, possibly falling back below 80,600.

The market may experience剧烈震荡 after Wednesday's rate cut, although it has been priced in提前. The probability of another rate cut in January is only 27%. Good news being realized can easily trigger a sell-off. If there are signs of a bull trap, consider布局空单提前.

ETH

Ethereum is still operating within the large box range of 4146-3011. As long as the upper boundary isn't broken and the lower boundary isn't breached, continue to buy low and sell high within the box for oscillation. Currently, the price is again consolidating around 3100.

Trading suggestion: Key resistance above is at the 3138 and 3260 levels. As long as it cannot break through, this is just an ordinary rebound, a short-term gap fill, not something to fear. For intraday shorts, support below focuses on 3050, 2980, and 2900. If it falls to 3050-3020 and holds, you can boldly go long.

Altcoins

In trading, many people discuss fundamentals, news, and technicals separately. But in my view, fundamentals and technicals are more like: two sides of the same coin!

Good projects: The fundamentals are truly strong, the product is delivered, and the technical chart will honestly reflect it. The long-term moving average keeps going up, and the price oscillates and rises around the moving average. This is called the value being gradually understood by the market. For example, $SUI and $HYPE in this bull market have been honestly moving up like this.

Bad projects: No matter how much they paint the technical chart, it's just a facade. The long-term moving average can't rise, and the entire trend looks messy.

News? It's the short-term jumps on the K-line. Positive news can temporarily push the price further from the moving average, negative news closer, but it can never change the direction of the long-term moving average because the moving average is pushed by fundamentals. $TON is a classic example. News is everywhere, plenty of positive news, but it just can't lift. Either there are fundamental flaws, or the moving average adjustment isn't finished. As long as the long-term moving average hasn't turned upward, no amount of news hype will help.

So just remember two sentences: First, fundamentals determine whether this coin can have a bull market long term. Second, the long-term moving average tells you which step it's at now.

News just amplifies the sound a bit; it doesn't change the major trend. Don't just FOMO when you see a coin suddenly has good news. It might pump short-term, but long-term, it still depends on the moving average.

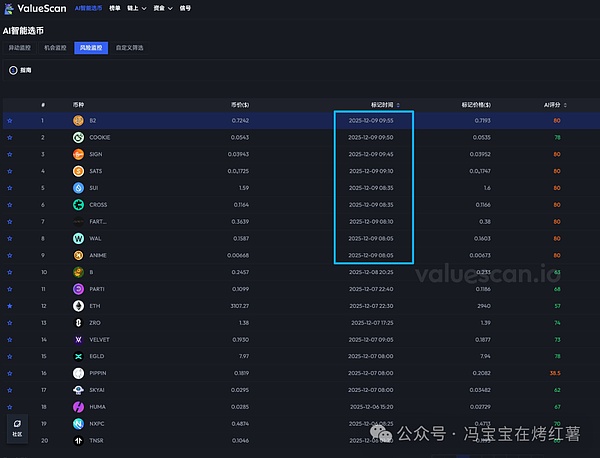

Found 9 risk tokens listed this morning!

Not many, but not few either. Usually, such shitcoins are only listed in batches when liquidity is very poor and there's no popularity. The fact that it appears near the反弹高点 of altcoins today requires caution. It's highly likely that market makers are exiting first, preparing to dump, and mainstream coins will follow with a correction later.

$ZEC

ZEC:注意分批落袋 (Pay attention to taking profits in batches). It rallied against the market, up nearly 20% at the highest, still up 13% now. The price has stabilized above $400. For the remainder,建议用小仓位继续格局 (suggest continuing to hold with small positions). If the 4-hour K-line can break and hold above the neckline, it should still be bullish short-term.

$FARTCOIN

fartcoin: Go long if it falls to the 0.38-0.36 range, stop loss at 0.342. Or wait for a breakout above 0.42 to enter long on the right side. Target above is 0.55.